Tanzania is one of Africa’s rising stars, with economic growth of a healthy 6 to 7 per cent, and a working democracy. Tourism is one of the main drivers of the economy, and the country benefits from its “twin” product of safari and beaches. Both, in my opinion, are the best in East Africa, with the fabulous Northern Circuit and world famous Serengeti, and the beaches and history of Zanzibar and the mainland.

Investors from the Middle East are waking up to Tanzania’s great potential, with several headline investments in recent years. One of the first major entrants to the market were the UAE’s Albwardy Group, which is the owner of the Kilimanjaro Hotel in Dar es Salaam, and the Zamani in Zanzibar, both operated by Kempinski. Dubai-based Kingdom Hotel Investments were the next, purchasing the Mövenpick Hotel in Dar es Salaam, and soon after entering into a US$20 million joint venture investment with Kuwait’s IFA, also in Zanzibar. Now Istithmar have arrived on the island, announcing a US$150 million resort there.

The Tanzanian government has given permission for further building in the Serengeti, with a planned expansion from the present 940 beds to 4,500. Ten times the size of Kenya’s Masai Mara Park, the government believes that this expansion is sustainable, and essential if the increased demand for safari tourism is to be met. Albawardy already have an investment there, again with Kempinski as managers.

Tanzania also has a tremendous opportunity for conference tourism, with excellent facilities in the northern city of Arusha, the gateway to the Northern Circuit, and the location of an international airport with daily flights from the Netherlands, Ethiopia and Kenya. The Arusha International Conference Centre has already hosted many international events, and will host the 8th Leon Sullivan Summit in June 2008.

Few countries can boast the combination of excellent conference facilities as well as the opportunity for pre- and post-conference trips to world class leisure destinations such as Zanzibar and the Serengeti. The famous Mt Meru Hotel in Arusha is now in private hands, and a joint venture between local and South African investors is poised to undertake a complete renovation, along with an expansion of the number of rooms and the conference facilities, in the coming months. Albawardy purchased the former Hotel

77 in the privatization process, for redevelopment as a mid-scale hotel, and other investors are known to be looking at this market.

Tanzania has experienced almost a 30 per cent increase in arrivals since 2000, to approximately 650,000 in 2006. Around one quarter of these were to Zanzibar, which is aiming for an increase to 500,000 in 2013. Constraints to future tourism growth are air access and hotel capacity. The potential arrival of SAA, Emirates and Qatar airlines into the Zanzibar and Arusha markets will ease the lack of transport, which should in turn promote further investment in hotel accommodation.

TANZANIA TOURISM DATA

|

Tanzania International Tourist Arrivals and Receipts |

||

| Arrivals | Receipts (US$m) | |

| 2000 | 501,669 | 739.1 |

| 2001 | 525,000 | 725.0 |

| 2002 | 575,000 | 730.0 |

| 2003 | 576,000 | 731.0 |

| 2004 | 582,807 | 746.0 |

| 2005 | 612,754 | 823.1 |

| 2006 | 644,124 | 862.0 |

| Source: MNRT, Tourism Department | ||

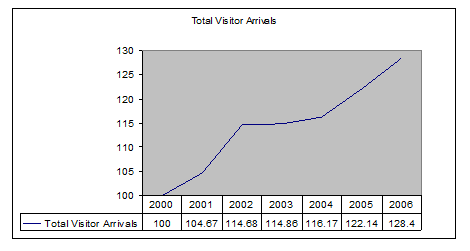

The following chart shows the indexed growth in visitor arrivals in Tanzania, using 2000 = 100.

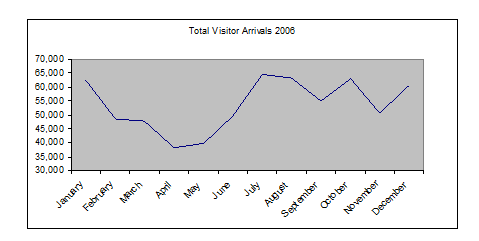

There is distinct seasonality in the arrival figures, as shown by the following chart:

The low months of April to June coincide with the rainy season, whilst the peak months of July, August, December and January coincide with the European and North American holiday seasons.

Of the total visitors in 2006, 56 per cent arrived by air, 41 per cent by road, and the remainder by rail and sea. The figure for road arrivals includes visitors from the region, as well as long-haul travellers (from Europe and North America mainly) arriving by road from Kenya.

Eighty-one per cent of visitors to Tanzania are on vacation, and 11 per cent are on business, with 8 per cent “other”.

Actual country/region of origin data for 2006 are as follows:

| Tanzania

Region of Origin, 2006 |

||

| Arrivals | % | |

| East Africa | 248,031 | 38.5% |

| Central Africa | 11,100 | 1.7% |

| Southern Africa | 30,650 | 4.8% |

| Other Africa | 3,659 | 0.6% |

| North America | 68,877 | 10.7% |

| Other Americas | 2,401 | 0.4% |

| Northern Europe | 94,724 | 14.7% |

| Southern Europe | 64,320 | 10.0% |

| Western Europe | 60,663 | 9.4% |

| Other Europe | 9,341 | 1.5% |

| Middle East | 6,815 | 1.1% |

| East Asia/Pacific | 28,222 | 4.4% |

| South Asia | 15,321 | 2.4% |

| Total | 644,124 | 100.0% |

| Source: GTB | ||

The top five generating countries in Africa were Kenya, South Africa, Malawi, Rwanda and Burundi. The top five generating countries in Europe were the United Kingdom, Italy, France, Germany and Spain. The USA and Canada are important sources of visitors, with Japan, China and Australia important sources in Asia/Pacific.

It is estimated that at least 75 per cent of tourists (holidaymakers) to Tanzania visit the national parks in the northern circuit, with Arusha at its centre, and therefore the data on park entrances are of relevance.

Trevor Ward

W Hospitality Group, Lagos

Tanzania is one of Africa’s rising stars, with economic growth of a healthy 6 to 7 per cent, and a working democracy. Tourism is one of the main drivers of the economy, and the country benefits from its “twin” product of safari and beaches. Both, in my opinion, are the best in East Africa, with the fabulous Northern Circuit and world famous Serengeti, and the beaches and history of Zanzibar and the mainland.

Investors from the Middle East are waking up to Tanzania’s great potential, with several headline investments in recent years. One of the first major entrants to the market were the UAE’s Albwardy Group, which is the owner of the Kilimanjaro Hotel in Dar es Salaam, and the Zamani in Zanzibar, both operated by Kempinski. Dubai-based Kingdom Hotel Investments were the next, purchasing the Mövenpick Hotel in Dar es Salaam, and soon after entering into a US$20 million joint venture investment with Kuwait’s IFA, also in Zanzibar. Now Istithmar have arrived on the island, announcing a US$150 million resort there.

The Tanzanian government has given permission for further building in the Serengeti, with a planned expansion from the present 940 beds to 4,500. Ten times the size of Kenya’s Masai Mara Park, the government believes that this expansion is sustainable, and essential if the increased demand for safari tourism is to be met. Albawardy already have an investment there, again with Kempinski as managers.

Tanzania also has a tremendous opportunity for conference tourism, with excellent facilities in the northern city of Arusha, the gateway to the Northern Circuit, and the location of an international airport with daily flights from the Netherlands, Ethiopia and Kenya. The Arusha International Conference Centre has already hosted many international events, and will host the 8th Leon Sullivan Summit in June 2008.

Few countries can boast the combination of excellent conference facilities as well as the opportunity for pre- and post-conference trips to world class leisure destinations such as Zanzibar and the Serengeti. The famous Mt Meru Hotel in Arusha is now in private hands, and a joint venture between local and South African investors is poised to undertake a complete renovation, along with an expansion of the number of rooms and the conference facilities, in the coming months. Albawardy purchased the former Hotel

77 in the privatization process, for redevelopment as a mid-scale hotel, and other investors are known to be looking at this market.

Tanzania has experienced almost a 30 per cent increase in arrivals since 2000, to approximately 650,000 in 2006. Around one quarter of these were to Zanzibar, which is aiming for an increase to 500,000 in 2013. Constraints to future tourism growth are air access and hotel capacity. The potential arrival of SAA, Emirates and Qatar airlines into the Zanzibar and Arusha markets will ease the lack of transport, which should in turn promote further investment in hotel accommodation.

TANZANIA TOURISM DATA

| Tanzania

International Tourist Arrivals and Receipts |

||

| Arrivals | Receipts (US$m) | |

| 2000 | 501,669 | 739.1 |

| 2001 | 525,000 | 725.0 |

| 2002 | 575,000 | 730.0 |

| 2003 | 576,000 | 731.0 |

| 2004 | 582,807 | 746.0 |

| 2005 | 612,754 | 823.1 |

| 2006 | 644,124 | 862.0 |

| Source: MNRT, Tourism Department | ||

The following chart shows the indexed growth in visitor arrivals in Tanzania, using

2000 = 100.

There is distinct seasonality in the arrival figures, as shown by the following chart:

The low months of April to June coincide with the rainy season, whilst the peak months of July, August, December and January coincide with the European and North American holiday seasons.

Of the total visitors in 2006, 56 per cent arrived by air, 41 per cent by road, and the remainder by rail and sea. The figure for road arrivals includes visitors from the region, as well as long-haul travellers (from Europe and North America mainly) arriving by road from Kenya.

Eighty-one per cent of visitors to Tanzania are on vacation, and 11 per cent are on business, with 8 per cent “other”.

Actual country/region of origin data for 2006 are as follows:

| Tanzania

Region of Origin, 2006 |

||

| Arrivals | % | |

| East Africa | 248,031 | 38.5% |

| Central Africa | 11,100 | 1.7% |

| Southern Africa | 30,650 | 4.8% |

| Other Africa | 3,659 | 0.6% |

| North America | 68,877 | 10.7% |

| Other Americas | 2,401 | 0.4% |

| Northern Europe | 94,724 | 14.7% |

| Southern Europe | 64,320 | 10.0% |

| Western Europe | 60,663 | 9.4% |

| Other Europe | 9,341 | 1.5% |

| Middle East | 6,815 | 1.1% |

| East Asia/Pacific | 28,222 | 4.4% |

| South Asia | 15,321 | 2.4% |

| Total | 644,124 | 100.0% |

| Source: GTB | ||

The top five generating countries in Africa were Kenya, South Africa, Malawi, Rwanda and Burundi. The top five generating countries in Europe were the United Kingdom, Italy, France, Germany and Spain. The USA and Canada are important sources of visitors, with Japan, China and Australia important sources in Asia/Pacific.

It is estimated that at least 75 per cent of tourists (holidaymakers) to Tanzania visit the national parks in the northern circuit, with Arusha at its centre, and therefore the data on park entrances are of relevance.

Trevor Ward

W Hospitality Group, Lagos

I wrote last month about the “march of the chains” – how for the first time the international hotel companies are devoting serious resources to increasing their presence in Africa. Why? Because their presence here is still woefully inadequate, compared to the coverage they have achieved in most of the rest of the world. And why now? Because the global focus on Africa has meant greater travel, to and within the continent, and travellers need hotels. A simple enough equation – would that hotel development in Africa were that easy! But I’ll leave that to another time………….

Africa, together with its islands, has 53 countries, so how to choose where to go? Most country capitals can support an internationally-branded hotel just because of the government and other activity there, and because they are the main international gateway of the country (although not always, think Nigeria, think South Africa). But once those dots are on the map, there need to be other reasons for expansion.

In general terms (and NEVER generalise about Africa!) there are two main sectors driving the economies of Africa, and therefore hotel development – oil and tourism. The continent is beset by problems, both natural and manmade, but at the same time it is blessed with an abundance of natural resources. And the world needs those resources, particularly the oil and gas. Fifteen per cent of the USA’s oil is imported from the Bight of Benin (Nigeria, Equatorial Guinea, Cameroon etc), and many billions of dollars continue to be invested in increasing the production of oil and gas there.

So many hotel companies – Hilton, InterContinental, Radisson SAS to name but 3 – are actively targeting the oil-producing countries, specifically Nigeria, Equatorial Guinea and Angola. Sudan is also a major producer of oil, and Khartoum is also a focus of attention, as is the south of the country, where a number of hotels are being developed in and around the new capital, Juba, to support the development of the newly-autonomous region.

Oil is also a major focus in North Africa, with Libya and Algeria witnessing increasing interest, especially in the former now that sanctions no longer prohibit the US-based chains from working there.

Elsewhere in North Africa, and in the east of the continent, tourism predominates as the reason for hotel development. Morocco and Tunisia are experiencing major development whilst Mombasa in Kenya is rising again as an exotic destination, often twinning with a safari; InterContinental are looking to re-enter that market after several years’ absence. Currently only Serena are the only international chain there. Presenting serious potential competition to Mombasa is Zanzibar, in my opinion one of the best destinations on the coast, with a fabulous tourism product. Kempinski and Serena both have great hotels there, with Mövenpick recently entering the market. Says Kristin Thorsteinsdottir of Radisson SAS “Zanzibar is on our wish list but barriers to entry seem to be quite high, there is a shortage of sites in good locations. It is my hope that the island will achieve room rates similar or higher to the ones currently achieved in locations such as Mauritius.”

Elsewhere in Tanzania, the safari product, better in many respects than Kenya’s, is receiving close attention, from Kempinski and others. Mozambique, profiled elsewhere in this edition, is also a “new” tourist destination, although the capital, has already experienced a glut of hotel development, largely driven from South Africa. (HN – if this is not the case and, let’s face it, you’re now the expert, please change it!).

But ask many if not most international chains, and they will tell you that South Africa is the main target for their expansion, not least because it is so much easier to develop there than most other places in Africa. But commercial considerations, of course, predominate. According to Radisson SAS’s Thorsteinsdottir, “Johannesburg, Cape Town and Durban all experienced double digit growth in RevPar last year. There is still room for growth in those locations and the Football World Cup in 2010 will provide exposure globally, giving the country a showcase opportunity across the sporting, business and general tourism markets”.

Expansion of the chains out of South Africa is also a new phenomenon, with Protea now operating around 25 hotels in 7 other countries in sub-Saharan Africa (and also in Egypt, the UK and Reunion). They have been particularly successful in penetrating the Nigerian market, with 9 hotels currently operating. Southern Sun, currently with just one hotel outside South Africa (in the Seychelles) are also seriously looking at Nigeria, with deals in Lagos, Abuja and Calabar on the books.

Who has been the most successful in Africa? Accor, by far, with 54 hotels and almost 6,500 rooms in 17 countries in sub-Saharan Africa. Add in North Africa, and that goes up to 124 hotels, almost 21,000 rooms and 21 countries. The other chains must be looking at that enviously, and wondering how they will ever catch up!

Trevor Ward

W Hospitality Group, Lagos

In today’s global village, there is increasing pressure for differentiation.

In today’s global village, there is increasing pressure for differentiation. There was a time when hotel chains prided themselves on the uniformity of their properties – “anywhere in the world, you’ll know that you’re in one of our hotels” – sure, but where in the world am I!

I have been travelling around various African capitals in recent months, and it strikes me that, whilst most developers are talking about constructing new 5 star hotels, they seem to be missing an opportunity in the market, that is the extended-stay hotel. Many of the cities I visit are absolute naturals for this type of hotel, as I shall explain. But first, an explanation of what an extended-stay hotel is.

Let’s imagine you are a seasoned traveller, who is in the habit of making fairly long visits when you leave home – perhaps a week or so at the time. Don’t you get fed up with having to rely on the hotel’s staff to do everything for you? OK, so increasingly you can make your own tea and coffee, but it would be nice to at least make your own toast for once! And perhaps to have a little more space to relax, or to work?

The extended stay hotel caters to just such demands, offering a fully-equipped kitchenette, and large accommodation units, ranging from 40 square metre studios to one and two bedroom apartments, with defined living, sleeping and working areas. Downstairs, the public facilities are limited, offering breakfast, vending machines and/or a mini-market, and little else. Some operators will sell the units only on a long-stay basis, weekly or monthly, others will take short stay guests when they are able.

Cities like Nairobi and Accra have several serviced apartment providers, but in almost all cases they tend to be apartment blocks which offer daily cleaning services, rather than the coherent product that brands such as Staybridge, Residence Inns and Homewood Suites offer in the USA.

Yet the markets are, as I mentioned, absolutely right for this kind of lodging product – expatriates relocating and waiting for permanent accommodation, aid agencies, bodies such as the UN and World Bank, teams of consultants, business travellers from Europe and the USA making longer than normal trips due to the distance, and so on.

At least two investors are looking seriously at the market. In Nairobi, ICDC Investments, a local financial house, are considering the development of a major new extended stay complex on a site in the CBD. And in Accra, Poly Group, a local manufacturing concern, are looking equally seriously at the market there.

What are the attractions of the extended stay model? Well, several! To start with, there are the strong demand dynamics noted above. Then there is the lower investment involvement, and the lower risk for the investor – there is no need to provide the extensive food and beverage, and other facilities, that full service hotels offer, reducing the up-front investment required, as well as the operating costs. And because the units are typically let on a long-term basis, there is less commercial risk for the investor, compared to the typical hotel. Plus, an extended stay hotel can, in the last resort, be converted to normal residential use as an alternative, providing an exit for the investor.

ICDC Investment’s Andrew Muriithi comments “We believe that the investment fundamentals of the extended stay product are more attractive to us than the typical hotel, which can have a much more volatile cash flow profile, particularly in African markets”.

In the USA, there are today more than 250,000 extended stay rooms, growing at an estimated 6 per cent per year, and achieving occupancy and average rate premiums over the mainstream hotel sector. Further, it is documented that extended stay properties can weather the storm better, experiencing better performance in downturns than the full-service hotels.

So why are there not more extended stay developers and operators entering the markets in Africa? Partly, I believe, this is due to the lack of maturity of the markets, which are only just beginning to see development outside of the 5 star sector –which tends to lead in developing economies – into the mid-market and budget sector. And also, there is a reluctance on the part of the global chains such as Marriott, Hilton and InterContinental, which dominate the market in the USA, to enter African markets with their extended stay brands before they have firmly established their core brands there first.

That to me represents a major opportunity for a savvy investor to exploit the markets with a home-grown brand.

Trevor Ward

W Hospitality Group, Lagos

I have been travelling around various African capitals in recent months, and it strikes me that, whilst most developers are talking about constructing new 5 star hotels, they seem to be missing an opportunity in the market, that is the extended-stay hotel.

I have written in previous editions about the interest that the international hotel chains are showing in Africa, seeking to expand their network in the face of increasing demand for hotel accommodation and other services. So if there is so much increase in hotel development, why isn’t the map covered in hotel flags? Progress is slow and, with the best will in the world, is likely to continue to be so. Why? There are many reasons, which all meet at the same place – lack of finance.

Hotels need long-term funding – they need equity investors who will wait up to 10 years to get their money back, and they need lenders who will offer terms which match the payment of interest and principal to the cash flows which hotels generate. In general terms (and never generalize about Africa!), neither of these are available. Home-grown investors tend to want short-term returns, domestic lenders do not have long-term deposits to lend, and overseas investors and lenders see too much risk.

In the past, many hotels, particularly those in capital cities, have been built by government – name any capital city from Abuja to Yaoundé and you’ll find government-owned hotels there. But they were built in the days when government investment in private sector activities was considered OK, and that’s not the case today, rightly so, with more fundamental social requirements needing those funds.

Investment in new hotel construction today comes mainly from three sources – domestic equity investors, “special” international equity investors and from bilateral and multilateral “special” lenders. Domestic equity investment predominates – majority stakes in the three main government-owned hotels in Nigeria’s capital Abuja – the Hilton, the Sheraton and the Meridien – were recently sold to domestic investors.

Gulf investors such as Kingdom Hotels Group and Albawardy Investments fall into the category of “special” investors who, whilst primarily interested in the commercial returns from their hotels, also have a non-commercial reason for investing, i.e. promoting national development and social welfare. Kingdom’s African portfolio includes several hotels in Kenya, and the $100 million Mövenpick project in Accra, Ghana. Albawardy have invested in two Kempinski hotels in Tanzania, and are planning more projects there.

Other special investors include the various Libyan government investment vehicles, with hotels under whole or partial ownership in Ghana, Togo, Gambia and others, and investments in management companies such as Corinthia and Legacy.

And then there are the special lenders, who have contributed so much to the development of hotels in Africa. Notable amongst these are the International Finance Corporation (IFC) and the European Investment Bank (EIB).

In June 2006, IFC alone had over US$100 million committed to the hotel sector in Africa in 14 countries – a tiny sum compared to other sectors, but still far more than any other lender. In recent years, its largest commitments have been in Nigeria (US$11 million for the development of the 430-room Novotel Hotel) and in Kenya (US$ 20 million for the refurbishment of Kingdom’s Fairmont portfolio). Notably, both of these investments have been alongside blue-chip local or overseas investors – UAC Property Development and Kingdom Hotels respectively.

EIB’s portfolio is smaller, totaling just over €40 million, but this excludes several small loans extended through lines of credit to local banks.

In my experience, financing for hotel development, especially in Africa, is almost always sourced locally. African investors need therefore to understand that, although the returns from hotel investments come later than they are used to, those returns are long-term and sustainable.

Trevor Ward

W Hospitality Group, Lagos