This is just not fair. You hear me? It’s not proper!

Travelers like me are proud of the hardships we endure, trekking around this continent, it’s what keeps us going, and we enjoy telling and retelling our “war stories”, of airports and hotels in dodgy places.

And then this happens.

They opened a new airport terminal in Luanda. No more scrums, no more daft forms to fill in, polite immigration officials, passport scanners, stamp, stamp and whoosh – I was through in two shakes of a lamb’s tale. Once again I had forgotten my vaccination certificate, and even then it took just 5 minutes and US$50 to get a new one (did I get an injection? Of course not!), from a very smiley doctor, who agreed that the health official who had very officiously marched me in to him, with lots of finger wagging, was a bit loco.

Extraordinary, in and through in less than 15 minutes. Shocked! Let’s just hope that there will be something to complain about at the new Luanda airport the Chinese are building at Viana (or not building, as the case may be – I hear the project is as good as abandoned).

But the Hotel Presidente still manages to triumph in the anti-customer care department, with the receptionist his usual unwelcoming, laid back self (he’ll check you in when HE feels like it, which is not necessarily the same thing as when YOU ask for it!), and the porter actually asking for a tip. Not a single staff member ever smiles, the barman is rude, the internet doesn’t work, the laundry isn’t operating. Just try to stay away from them, they might do the decent thing one day and go away. On check-out, not a single word of apology for overcharging me on every single item on my bill.

Happily, there are some new hotels opening, at last. The Hotel Talatona in Luanda Sul is really nice. Pricey – US$600 for a single room (yes, that’s for one night!) – but the staff know how to smile, and everything appears to work!

Happy Travels- even in Angola!

Trevor

How to make a success of hotel investment?

In Djibouti, the 177 room Kempinski Hotel was built in just nine months. In Accra, the 100 room Labadi Beach Hotel took a little longer, all of 10 months, but still a record-breaking length of time, that would be the envy of any developer in the west.

So why is it that so many hotel projects in sub-Saharan Africa take such a long time to become reality, with several years’ delay by no means unusual? Examples include the Holiday Inn in Accra, in its sixth year of construction, the Radisson SAS in Lagos, due to open in November 2004 and still on-site, and the Hilton in Kampala, due to open in 2007 and still some way from completion.

And what could, what should be done by investors to stop such a waste of opportunity happening on their projects?

In my experience, so much can be laid at the door of a lack of planning. I believe it was Conrad Hilton who said that the three main success factors for a hotel are location, location, location. Well, that’s a good soundbite, oft repeated in the industry, and it does have much to say about the operational success of a hotel. But I think it is planning, planning, planning that marks the success or failure of your development project.

Here are the four main areas where, in my experience, proper planning brings success:

Hotels are difficult, hotels are complex, hotels are big projects. Like in any endeavour, from preparing a meal to landing on the moon, a multitude of skills is required, and the secret of success of projects like the Kempinski in Djibouti is to leverage off the skills of the individual team members. Every developer knows they need an architect – but hotels are not big houses, they are far more complicated, and the architect must have previous experience of proper hotel design.

The project needs managing, and the project manager needs to be involved from the very early design stages. Project management is a skill which requires experience, and rarely, in my experience, does the investor or the architect have that skill, leading to some of the serious delays that we see. Do the maths – a year’s delay in opening a 200 room project, because the project is not properly managed, could mean a loss of in excess of US$10 million in revenue [YOU MIGHT WANT TO PUT A BOX IN TO SUPPORT THIS – SEE THE END OF THIS DOCUMENT].

The international hotel chains have years of experience in hotel design, knowing what works and what does not. The basic objectives of a hotel design are: to deliver what the guest wants; to maximise the revenue-generating possibilities of the building; to minimise the non-revenue generating areas, whilst still providing sufficient support space; to minimise operating expenses; and thereby to maximise the return on the owner’s investment.

When an architect puts the bathrooms on the outside wall, instead of the corridor wall, “for ventilation”, or a toilet in the middle of the kitchen “for when the chef gets caught short”, or omits any staff facilities, you can be sure that the experts have rejected such design elements long ago for good reason. Architects who insist on ignoring conventional wisdom are ensuring that your hotel will be obsolete when it opens, hugely vulnerable to competition.

I know of several hotels, including the Radisson SAS in Lagos and Le Meridien in Port Harcourt, where expert design experience was sought only after starting construction, which brought substantial delays in completion, and cost overruns, which could have been avoided.

So the management company, if one is to be engaged, must be on the team from the get-go – there is absolutely no logical reason why their appointment should be delayed.

As difficult as it may be (and it is arguably getting easier, with new sources of debt and equity available) to fund hotel projects, it is even more difficult to raise money for a half-completed hotel. There are dozens of hotels around Africa, possibly hundreds, where the cost of construction has been underestimated, and funds have run out, or where construction has started without all of the funding in place.

Disruption of the construction due to lack of funds leads to demobilisation of the contractor, the loss of skilled workers, additional cost, completion delays, and lost opportunities. All of which could have been “planned-out” of the process by ensuring from the outset that sufficient funds are available.

And finally, I can come back to the issue of location (times 3!). Many investors seem to believe that, because they own a site, it is suitable for hotel development. Well, not necessarily! Selecting the correct site is part of the planning process – just because demand is high today, and land is hard to come by (a feature of many, many markets in Africa), these are not good reasons to go ahead with a hotel development on a secondary site. Markets are never static, changing over time, and a location which will “do” today, because of high demand and lack of customer choice, is likely to be

at a disadvantage in the future when supply: demand imbalances are evened out. Conversely, locations can change – look at the decline (and subsequent slow reawakening) of the centre of Johannesburg, where the city’s main 5 star hotels were once located – but this tends to be in mature markets.

Many of Africa’s hotel markets are experiencing a shortage of supply in the face of high and increasing demand – e.g. Lagos, Accra, Cape Town, Luanda – and as a result entrepreneurs are rushing in to exploit the situation. Those that plan properly from the outset – getting the design right, putting the funding in place and having the right development team on the project – are creating sustainable businesses. Those that fail to plan, plan to fail.

A hotel with 200 rooms, achieving 50% occupancy in its first year of operation, will sell 36,500 roomnights. At an average daily rate of US$200, that’s rooms revenue of US$7.3 million. With other revenues from meals, drinks and other services, that’s at least US$10 million in total revenue.

Trevor Ward

W Hospitality Group, Lagos

trevor.ward@w-hospitalitygroup.com

Kenya’s government has been brought to a standstill and finance minister Amos Kimunya has been forced to resign at news that Nairobi’s showpiece Grand Regency hotel was secretly sold to the Libyan Arab Africa Investment Company at a vastly undervalued price. The hotel was sold without negotiation for an official figure of KSh 2.9 billion – a fraction of the KSh 6 billion top-price estimate being bandied about in the media, but the price has caused a storm of debate as to whether the sale price was fair and reasonable or a huge undervaluing of the property.

The scandal highlights how key an issue valuation is in hotel investment and ownership – how does one ensure an accurate price for the investment when one wants to buy, and what constitutes a fair valuation? What influences hotel valuation? There are many factors to take into account when valuing hotels from their capitalization rate and their room rates, as well as on both their historical earnings and on their current and future earnings.

Other factors such as the health of the hospitality industry and political and economic prospects impact values. The bidding process is also crucial – the Grand Regency transaction was particularly hit by accusations of a lack of transparent bidding that could have pushed up the value of the hotel.

This article should outline, using case studies to back up each point, as far as possible, what hotel investors should be aware of when buying into or preparing to sell a hotel property. You could start by discussing Africa’s hotel valuation / sale history? Explain some successful sales or nightmare scenarios for the investors that have hit headlines – like the Regency. What has actually happened there – can you give some insight?

What makes a successful valuation, and how advanced is the industry in Africa? What are the key factors to be noted in this equation? What affects valuations? Who should investors go to for this?

You might want to add in something about who hotel buyers and sellers tend to be in Africa – are they governments, local investors, international groups? Where are these trends headed – towards more local investment, or something else? What’s directing the market?

You might also want to talk about the process of pricing and negotiating a sale – like, what makes an ideal buyer or seller, and what does a viable and mutually profitable deal need to have as its elements?

Offer your experience – where have you seen successes happen and why? What tips would you offer for investors looking for valuation?

This gives a public view on the Regency scandal – you maybe know more about it than this? Do you agree with the writer?

Trevor Ward

W Hospitality Group, Lagos

trevor.ward@w-hospitalitygroup.com

Oil and diamonds drive Angola’s economy, and both commodities are experiencing high prices, resulting in GDP growth at exceptional levels – some 20 per cent in 2007. And this translates directly into demand for hotels. Luanda is experiencing occupancies above 90 per cent year round, with bookings required weeks in advance – and even paying in advance won’t necessarily guarantee you a room!

Tourism figures from the Angola authorities are difficult to reconcile with this surge in demand, reporting a decrease in 2006 – but I believe this is due to a change in counting methodology, excluding those coming in for short-term employment from the figures. More likely there is an increase of at least 10 per cent in arrivals year on year, which is the Ministry of Hotels and Tourism’s forecast for the next 5 years, an estimate more than supported by the very high occupancies experienced by hotels in Luanda and elsewhere, and the high load factors of the incoming airlines.

International investment in Angola is growing, mainly for the reconstruction of the country’s infrastructure and in industry. The main investors are the European Union (EU) and the EU countries individually (mainly Portugal), as well as the USA, China and South Africa.

Over 80 per cent of all arrivals to Angola originate from overseas, while 16 per cent originate from within Africa:

| Angola

Region of Origin, 2005 |

||

| Arrivals | ||

| Europe | 110,025 | 52.4% |

| Africa | 45,100 | 21.5% |

| Americas | 36,140 | 17.2% |

| Asia | 16,748 | 8.0% |

| Middle East | 1,243 | 0.6% |

| Australia | 700 | 0.3% |

| Total | 209,956 | 100.0% |

| Source: MHT | ||

Almost 70 per cent of all arrivals originate from seven countries (2005 data not available):

| Angola

Country of Origin, 2006 |

|

| Portugal | 21% |

| Brazil | 9% |

| UK | 9% |

| South Africa | 8% |

| China | 8% |

| France | 8% |

| USA | 6% |

| Total | 69% |

| Source: MHT | |

The majority of visitors to Angola are entering for business and employment, the latter largely in the oil and gas industry:

| Angola

Reason for Entry, 2005 |

|

| Employment | 69% |

| Leisure and VFR* | 15% |

| Business | 13% |

| Transit | 3% |

| Total | 100% |

| Source: MHT

* – Visiting friends and relatives |

|

Angola has considerable leisure tourism potential, but this is unlikely to be exploited for some years, due to the image of the country, the lack of available air capacity and therefore the high airfares, the cost of hotel and hospitality services, the lack of road infrastructure outside of the main cities, and the proliferation of landmines. Many of the leisure visitors are VFR, from the Diaspora in Portugal and Brazil.

The attractions of Angola, which in the future can be exploited for tourism, include:

| · Beaches

· Sport fishing · Game parks · Adventure tourism |

· History and culture

· Natural landscapes · Bird watching · Whale watching. |

The hotels in Luanda accommodate only very small volumes of leisure travellers, and it is not expected that this market sector will grow in the short- to medium-term.

In response to the high demand, several new projects are underway in Luanda – Korea’s Namkwang are building a 250-room InterContinental Hotel, Sivol a 300-room Hotel Sana (a Portuguese operator and investor), and MITC are the developers of a 64-room extended stay property, a product well suited to the type of demand there.

Outside of Luanda, expect more hotel development in Lobito, where a US$3 billion oil refinery is to be built, and in Soyo, where a US$5 billion LNG plant is under construction. In Soyo, a 100-room hotel is to be built by local investor Dania Comercial, and is reportedly already almost fully taken up with demand from the LNG plant. Benguela has tourism potential, with existing beach resorts attracting demand from Luanda at weekends. Cabinda, the enclave within the territory of the Democratic Republic of Congo, is the centre of Angola’s oil industry, and there are plans for massive investment in housing and hotels there.

Such tourism as has been developed is mostly in the south of the country (Namibe Province), with demand generated by the South African and Namibian markets, who drive into the country and visit the game parks and participate in adventure activities in the desert. Road and air access from Luanda has improved recently. The two existing hotels have insufficient capacity for expected growth in demand.

The Angolan authorities are keen to expand the tourism industry, in order to diversify the economy away from primary products, and to take advantage of the country’s natural assets which, due to previous internal problems, have been virtually unexploited. Investment in tourism will bring considerable benefits to the population in rural areas, who see little benefit from the oil industry.

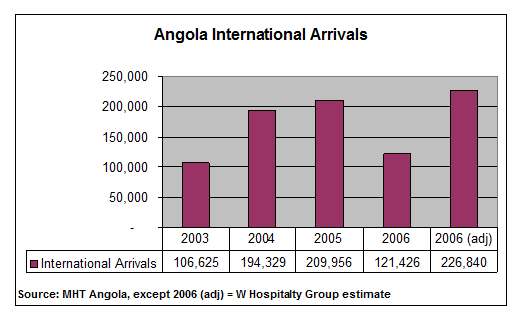

The following data on the number of international arrivals in Angola have been provided by the Ministry of Hotels and Tourism (MHT):

Whilst the reduction in arrivals in 2006 reported by the Ministry is said to be due to a reduction in major conferences compared to 2005, an analysis of the detailed data reveals that the actual reason appears to be a change in methodology of data capture – almost the entire reduction is due to a reduction in the number of migrant workers, a proportion of whom are clearly no longer counted as arrivals. Applying 8 per cent growth to the 2005 figure (2005 was 8 per cent higher than 2004) results in a figure of approximately 227,000 visitors in 2006 (shown above as “2006 adj”), an increase which is conservative and more than supported by the very high occupancies experienced by hotels in Luanda and elsewhere, and the high load factors of the incoming airlines.

Trevor Ward

W Hospitality Group, Lagos

trevor.ward@w-hospitalitygroup.com